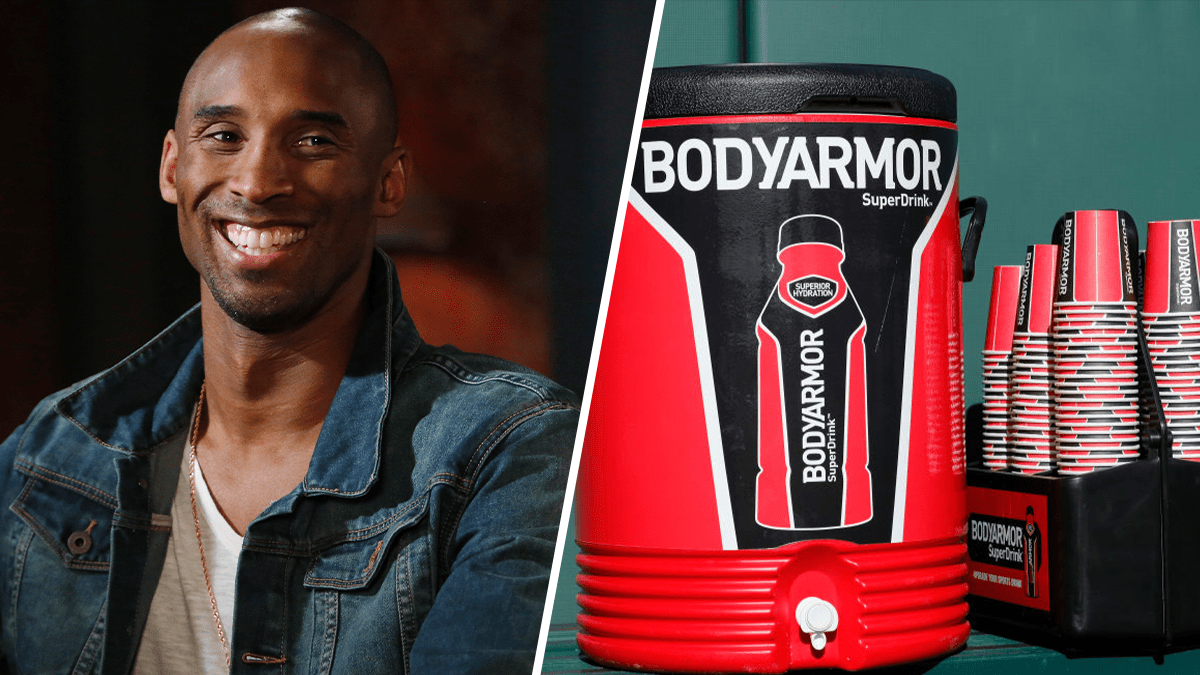

On Monday, beverage big Coca-Cola acquired full management of sports activities beverage maker Bodyarmor in a $ 5.6 billion acquisition, CNBC studies, bringing in an estimated $ 400 million within the property of late basketball legend Kobe Bryant.

The NBA star, who died in a tragic helicopter crash in January 2020, grew to become a Bodyarmor shareholder in 2013 when he invested hundreds of thousands of {dollars} and joined the board of administrators.

“I introduced my pores and skin into the sport,” Bryant informed Forbes in 2014 after his heavy funding.

Coke has held a 15% stake in Bodyarmor since 2018 when it grew to become the second largest shareholder. This buy made Bryant the corporate’s third largest shareholder on the time.

Bryant confirmed enterprise prowess after retiring from the NBA in 2016, with offers in a wide range of sectors together with “a media manufacturing firm and a enterprise capital fund to put money into know-how, media and information firms,” NBC Information reported in 2020.

The deal for Bodyarmor, based in 2011, is the most important acquisition Coke has ever made. It has been within the works since at the very least February, studies CNBC, primarily based on a pre-filing with the Federal Commerce Fee.

Bryant’s property, which Forbes reported was price as much as $ 600 million on the time of his demise and which widow Vanessa Bryant inherited, will repay roughly $ 400 million from the deal, studies the Wall Avenue Journal.